The FORAD simulation details

The FORAD simulation details

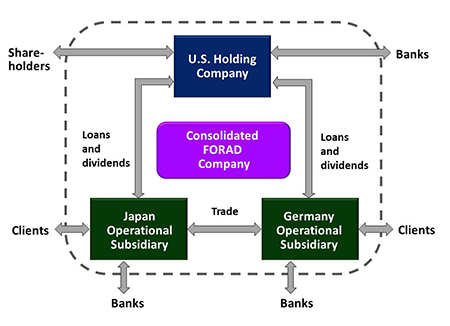

The participants at the simulation manage a US-based public company with two foreign subsidiaries and are responsible for decisions in the areas of forecasting, operations and budgeting, choice of financing options, risk management and international taxation strategies, and shareholders’ relationship.

Success is determined by the teams’ ability to understand the key corporate finance concepts and apply those lessons in a competitive and unpredictable market environment – subject to the simulation.

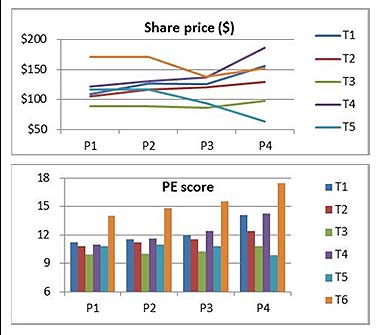

The ultimate goal is to increase shareholders’ value consistently throughout the competition – measured by the company’s share price.

The software generates all reporting and data tools the participants need to be able to analyze their performance and monitor the industry and the market.

- The FORAD company

- Decisions details

- Performance measures

- Results and reporting

The FORAD company has three subsidiaries – US Holding company and two international subsidiaries – one in Germany and one in Japan.

The subsidiaries work with each other and with external business partners to sell their production, access capital, engage in hedging or speculative activities.

The goal is to optimize the performance of the consolidated FORAD company and outperform the rest of the industry.

Preparation - analyze company’s results; study competitors; forecast market data; set goals and plan the current period

Operations – decide capacity and production levels; look for ways to improve revenues and profitability

Financing and investing – review company's capital needs or excess resources; borrow or repay debt; decide on maturity and currency; issue equity or buyback shares; transfer funds internally

Tax management – search for opportunities to lower corporate tax rate – via Inter-Company loans, transfer pricing, Inter-Company dividends

FX management – review foreign exchange exposures and decide on hedging approach and/or speculative positions

Review – examine expected results; stress-test for unexpected market data; think of ways to increase EPS and/or PE score; review compliance; adjust the decisions

The FORAD company performance is measured by the company's share price:

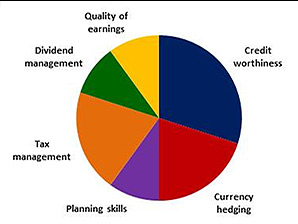

The PE score is a combination of a number of performance measures with different weights – it reflects the management team’s ability to build a healthy organization positioned for long-term success:

PE score elements:

- Credit worthiness - Debt/Assets ratio, debt maturity, interest expense

- Currency hedging - foreign exchange gain or loss compared to conservative hedging approach

- Planning skills - team's success in predicting key market data and company's actual final results

- Tax management - ability to minimize the effective tax rate

- Dividend management - level and consistency of company's dividend

- Quality of earnings - size of non-core earnings, potential dilution effect, consistency of the earnings period over period

The software provides detailed REPORTING and a number of other DATA TOOLS to help the decisions and review processes.

Individual teams’ detailed results:

-

Financial statements by subsidiary in local currency and in USD

- All current and historical decisions and results by position

For the competitors and the industry:

-

Consolidated financials and operational highlights, share prices and PE scores by competitor

- Market data and economic forecasts